Hey coffee lovers,

If you have been watching the news, you’ll know that the cost of coffee right now is a topic hotter than a roasting drum at first crack. As green bean importers of specialty arabica coffee, we’ve seen a lot over the years, and we think it’s helpful to know why this happening. Then, let’s know what you can actually do about it, as roasters, as cafe owners, and as consumers.

If you still have questions about this price increase after reading, get in touch with us, either via your Project Origin sales rep, or find us on social media. We’ve said it before, and we will say it again: when the market moves around us, we can better ourselves, our friends, and our industry, when we collaborate together.

So, let’s do this.

In less than 12 months, the price of commodity coffee has more than doubled.

You read that correctly. More than doubled. In March 2024, commodity coffee was priced as low as $1.81 USD/lb. In February 2025, we are looking at over $4.00 USD/lb. For the same coffee. And this is not for the specialty beans that we thrive to enjoy – this is just the commodity market, the type of coffee you might find in instant coffee jars.

Want that stat in kilos? We have jumped from $3.99 USD/kg to $8.83 USD/kg. For green coffee at origin.

Do you remember the article we shared at the start of 2022 where we talked about massive price jumps? The post covid coffee prices saw an 80% increase, too. So it’s no wonder we feel like we can’t catch a breath with financing our coffee supply.

Why is the c-market price moving so quickly?

Commodity Super Cycle & the economic market

Coffee is a commodity, meaning it’s a physical, tangible thing. Other commodities that exist on the trading market include minerals (things like metals, gold, copper), oil, and all agriculture. Globally, the economy is moving towards a commodity super cycle, meaning we are favouring the commodities rather than virtual things, such as technology.

There are a lot of things that impact the prices of commodities. Just a few of these include:

Each of these elements influence the price of buying coffee on the global market. And make no mistake, the increase in prices does not always equal the coffee producers and farmers receiving more of your money. We wish it were that simple.

Whenever we see a volatile market or experience uncertainty in the above events, people tend to gravitate towards the security of physical things, as well as gravitate towards the perceived security of the US dollar (which inherently strengthens the US dollar).

Speaking of, coffee is bought and sold in US dollars, so for our roasting partners and friends in Australia – we have the added bonus of throwing the weaker Australian dollar conversion on top of this price. But don’t let this stop you from buying stock – we can approach these two facets separately. Your trusted green bean importer can help you navigate this. Ask us how we can manage this kind of rick with you. We do it everyday.

Supply and demand – it’s a simple, yet impactful scenario: supply around the world is going down + consuming demand is going up = price goes ⬆️

Brazil is currently on their 5th consecutive year of a decreased overall supply. This harvest, Vietnam saw unfortunate weather, decreasing its supply too. What does this mean? It means that companies around the world – from micro roasters, to coffee company chains, to global giants need to find their total volumes from somewhere. The missing volume has to be made up for, so they look at other origins to substitute. Of course, this then eats into that origin’s total supply… and so the cycle goes until there is nothing left.

Because supply is low and demand is high, and because the base line price has increased so much, producers are selling their harvested stock to the bidders who can pay them first. In previous years, we were able to negotiate higher prices with financing options to ship in later months. But with the cost of financing being so high (for some coffee producers, this is between 20-40%), and the current c-price being so reasonable, there is no reason for producers to wait to be paid upon shipping.

All of this means: stock is disappearing fast.

Unsurprisingly, mother nature is also contributing. Climate change is influencing weather patterns that directly impact total supply during harvest. Remember that article we shared in 2022? Here’s what we said:

“While a shift in price like this has been needed in our industry for a long time, the catalyst for such a dramatic adjustment has been the 気候変動です。 severely impacting Brazil, which is the largest global coffee producer. The droughts and frosts this year have damaged the coffee trees not only for this season’s harvest, but also for 2022 and possibly 2023 harvests as well. It is the largest environmental damage caused to the country in 7 years.”

Coffee trees take 3-5 years to grow to maturation for a full harvest. Any trees planted in Brazil to counter these environmental damages are unlikely to be producing a full harvest yet. This is how long of an investment growing coffee takes.

What can i do as a roaster?

Forecast your stock.

We cannot say this with enough importance, so let’s repeat it:

Forecast your stock!

Coffee is harvested, and most origins only harvest once per year. Whilst this may sound a bit obvious, what this means is we need to consider what we want from that harvest to last us until the next harvest. We cannot get half way through the year and decide, “i’ll just order some more”. It doesn’t work like that anymore.

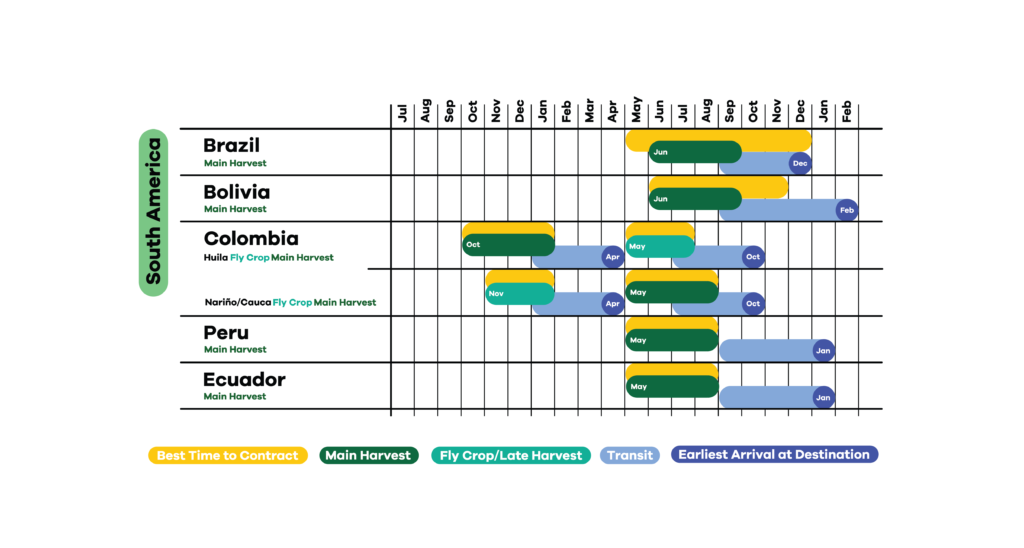

So as a roaster, you need to be thinking in terms of the harvest calendar when planning your stock needs. Don’t know when origin’s harvest? Download our free Project Origin Harvest Calendar, and note the yellow highlights for when to action.

Historically, green bean importers have covered your rotation needs by offering you spot options. Every time you have purchased a coffee on spot, you need to realise that we – the green bean importers – had to predict you would need spot coffee 8, 10, sometimes 12 whole months before you even thought of it yourself. We cannot simply reorder spot coffee for you, we have to buy it during the harvest months.

We helped you with your spot and rotation needs whilst we played the harvest games, and now, we are in a position where we are asking you to plan with us based on harvest, not based on spot. We don’t expect you to know exactly what you want – we have been playing this game a lot longer, as have all other green importers. We can help you forecast appropriately. Together, as a team, we can keep your stock stable and ensured. But we can’t do this when harvest is over, and there is no more physical stock left to buy.

As a roaster you need to:

Doing this will help ensure you have planned ahead so you can then focus on other important aspects of your business. We have found some great opportunities this harvest around the world to help support your blends and single origin rotations, so let’s get this secured for you based on your needs.

Want to talk to Project Origin about this? Email your Sales Rep, or contact us at [email protected] to get ahead.

What can i do as a consumer?

It’s tough. Watching your favourite cafe increase the cost of your cappuccino – AGAIN. With the budget you do have for your luxury coffees, try and support your local cafes and local coffee roasters. These market fluctuations are taking us for a serious ride behind the scenes, and we are doing the best we can at each point along the line to keep prices affordable, or at least attainable.

Support your local and your favourite businesses, and don’t be afraid to ask questions. You deserve to know why the price has increased. We hope this article has helped that understanding. Like we said at the start, we can continue sharing incredible coffees by sticking together, supporting each other. Project Origin strongly values the long term relationships we build over the years, and we know (from personal experiences both in front and behind cafe counters) that long term relationships with your cafe teams matter, too.

Ready to forecast your stock for your roastery? Contact us at [email protected] and together, let’s thrive.

ProjectOriginプロジェクトとスペシャルティグレードのグリーンコーヒーの���新情報を入手してください。

私たちは、私たちが働いている土地の伝統的な所有者であるングンナワルの人々に感謝します。私たちは、過去、現在、そして新興の長老たちに敬意を表します。